The High Court in Timaru has been told that the former chairman of South Canterbury Finance, the late Allan Hubbard, had a disdain for legally required business practices.

After five months of evidence from 40 witnesses, as well as dozens of written statements, lawyers arguing the fraud trial of Lachie McLeod, Edward Sullivan and Robert White have begun closing submissions at the High Court in Timaru on Tuesday.

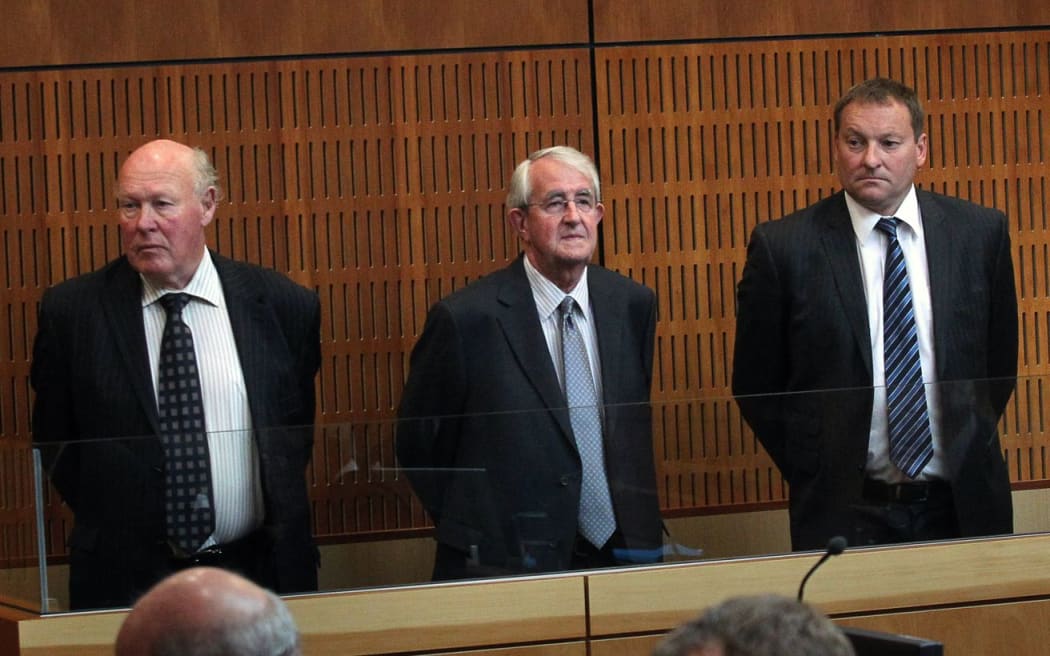

From left: Edward Sullivan, Robert White and Lachie McLeod. Photo: Mytchall Bransgrove

The men deny 18 fraud charges brought by the Serious Fraud Office following the 2010 collapse of the company and the subsequent $1.7 billion Government bailout. They include theft by a person in a special relationship, false statements by a promoter, obtaining by deception and false accounting.

The Crown has begun its closing submissions with prosecutor, Colin Carruthers QC, telling the court the defendants simply ignored or overrode controls that should have regulated how the company operated.

He said Mr Hubbard, who died in a car crash in September 2011, had little interest in various accounting and legal restrictions placed upon him and the three accused knew that.

Mr Carruthers said the men did not just ignore Mr Hubbard's practices but actually helped facilitate the improper way the company was run.

"These defendants did not just turn a blind eye. The case is about the affirmative statements they made and the affirmative actions they took that breached the controls on the company."

Mr Carruthers told Justice Heath that much of the case has been concerned with the legal requirements of accounting standards. However, he said the prosecution does not stand or fall on a close analysis of those standards.

The evidence of improper reporting and improper accounting does not require fine issues of judgement because the breaches in question are obvious, he said.